Many taxpayers feel trapped by overwhelming IRS debts, and understandably so; the good news is that there’s a way out. One of the most effective IRS tax relief options is the Offer in Compromise (OIC). With numerous Offer in Compromise success stories annually, the program allows taxpayers to settle their tax debt for less than the full amount owed and halts aggressive collection actions. It’s a valuable option for those who are struggling to pay their taxes in full, whether due to financial hardship or other reasons.

At Victory Tax Lawyers, we assist both individuals and businesses in navigating the OIC process. From determining your eligibility to helping you craft a strong offer, our experienced tax attorneys are there to handle every detail and secure the best possible outcome for you. If you’re considering reducing your tax burdens, reach out today for a free attorney consultation.

In this post, we’ll highlight real-life Offer in Compromise testimonials of individuals who have used the program to resolve their tax issues and how you can achieve the same outcome.

What Is an Offer in Compromise and Why Is It Hard to Get Approved?

An Offer in Compromise is a debt relief program offered by the Internal Revenue Service (IRS) that allows taxpayers to settle their tax debt for less than what they owe. This program offers a lifeline for individuals and businesses struggling to pay their tax obligations or stuck in a debt rut, helping them regain financial stability and move forward with confidence.

When taxpayers submit an OIC, they suggest a settlement amount based on their financial situation rather than their total tax liability. If the IRS approves the offer, it will accept this lower payment, effectively resolving the outstanding tax debt. While not everyone qualifies, the program has been incredibly helpful for those who do, offering a valuable opportunity for a fresh start.

Who Qualifies for an OIC?

While an OIC is generally designed for taxpayers who genuinely cannot pay their full tax debt, the IRS enforces strict eligibility requirements before even considering your application. This means that not every applicant is approved for an Offer in Compromise.

The IRS typically evaluates the financial situation of the applicant by taking a look at their assets, income, expenses, and ability to pay. So, for instance, if you’re somehow able to fully pay your liabilities, perhaps through an installment agreement or other means, you won’t qualify for an OIC.

Eligibility Requirements

To qualify for an OIC, you must first meet the IRS eligibility criteria. Only then can you prepare a preliminary proposal. Here’s a checklist to help you determine if you’re eligible:

- Tax Compliance: You need to have filed all required tax returns, received a bill for at least one tax debt included on the offer, and made any necessary estimated payments for the current year.

- Bankruptcy Status: You cannot apply if you’re currently in an open bankruptcy proceeding. The IRS only approves cases of those who do not have an open case or whose cases have been discharged and closed.

- Current Obligations: If you’re applying for the current tax year, you must have a valid extension for your return.

- Employer Responsibilities: Business owners with employees must have made tax deposits for the current and past two quarters before applying.

Understanding these criteria can save you time, effort, and potential frustration. You can easily use the Offer in Compromise Pre-Qualifier Tool to help you wade through this process with less frustration. Once you meet these requirements, the next thing is to prepare a preliminary proposal.

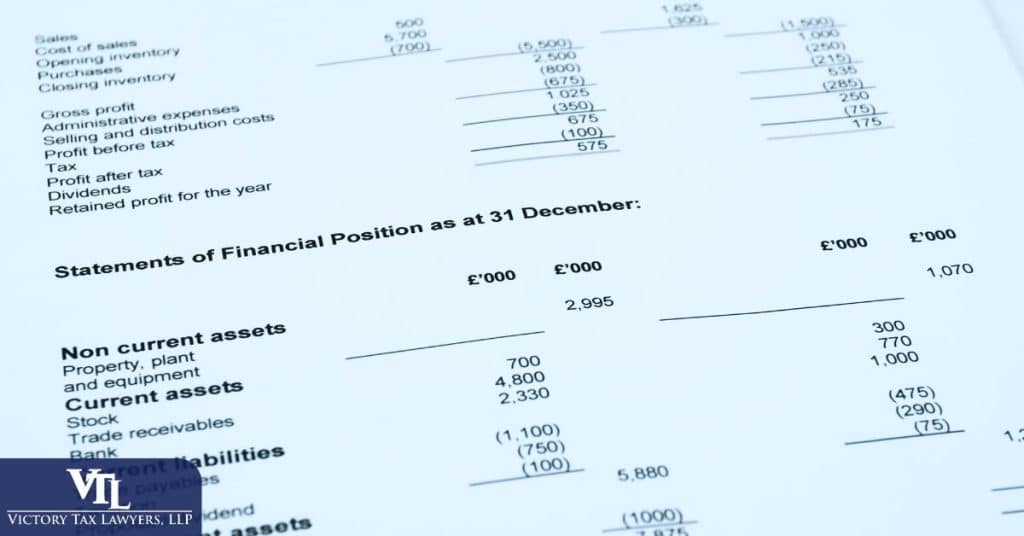

Financial Documentation

The next thing to consider after meeting the eligibility criteria is your financial situation. The IRS relies heavily on your financial documentation when determining whether to grant you an OIC or not. The IRS focuses particularly on you:

- Bank statements

- Pay stubs

- Tax returns

- Details about your assets and liabilities

While applying, it’s important to have these figures handy and up-to-date. The key is to provide accurate, thorough documentation showing your inability to pay. This includes everything from your income statements to a detailed list of your monthly expenses. The more information you can provide, the better your chances of being approved. If you are unsure about this, hiring an experienced tax professional to help you handle the process is your next best option.

Offer in Compromise: Success Stories of IRS Tax Relief

For many taxpayers, dealing with the IRS can feel like an uphill battle. But with the right attorney helping you, it does help a great deal. At Victory Tax Lawyers, we’ve secured incredible results through the OIC program. Here are real stories of people who overcame overwhelming tax burdens with successful OIC resolutions.

Success Story 1: From Over $37,202 to Just $160

When the pandemic disrupted businesses nationwide, one small business owner faced mounting payroll tax debt totaling $37,202. With irregular income and increasing penalties, they were on the brink of losing their business.

As the debt grew, so did the penalties and interest. Our team stepped in and worked closely with them to present a compelling case to the IRS. We succeeded in negotiating an Offer in Compromise for just $160. This resolution reduced the client’s liability by over 99%. With their tax debt cleared, they could now focus on rebuilding their business.

Success Story 2: $1 Million Tax Debt Reduced to $16,194

A professional earning a steady income faced a tax debt that had grown to an astronomical $1,096,964 because of years of unpaid taxes and penalties that had accrued over time. Despite their income, their tax obligations were making it difficult to clear up such massive debt.

We prepared a compelling case demonstrating our client’s inability to pay the full amount, even though they could still meet their basic living expenses. The IRS approved an offer of $16,194—less than 2% of the total debt. This led to tax savings of more than a million dollars.

Success Story 3: $149,909 Tax Debt Settled for $50

Another case we handled was that of a retired couple who were already stretched thin by unexpected medical expenses but found themselves owing $149,909 in back taxes. Since they were living on a fixed income, they could not pay off such a massive amount.

Luckily, they reached out to us. After exploring their tax relief options, we helped the couple submit an Offer in Compromise. Our attorneys were able to negotiate and convince the IRS to accept an offer of $50. This resolution wiped out their tax debt entirely, allowing them to enjoy their retirement years without worry.

Success Story 4: $53,325 Tax Liability Settled for $100

For a self-employed freelancer, managing irregular income is always a challenge. This was the case with this particular client; inconsistent payments spiraled to missed tax deadlines and a whopping $53,325 in tax liability. They were constantly living with the fear of garnishments or federal tax liens. Thankfully, they decided to take action and reached out to us.

Our team built a solid case, and the IRS agreed to an Offer in Compromise of a meager $100. This resolution eased the financial burden and helped the freelancer to focus on their work without having to worry about IRS collections.

Common Traits of Successful OIC Cases

If your goal is to get your Offer in Compromise approved, it helps to know what works. From the successful cases we’ve handled, there are a few things that tend to stand out. These common traits can make all the difference when it comes to getting your offer accepted.

1. Accurate and Complete Financial Documentation

As we already mentioned, the IRS requires a clear picture of your financial situation, as this helps them evaluate your ability to pay. Missing or inconsistent records can raise red flags, delay the process, or even lead to outright rejection. This means double-checking everything: your income statements, bank records, monthly expenses, and even asset valuations. The more precise and transparent you are, the stronger your case will be.

2. Demonstrating Genuine Financial Hardship

At the core of securing an OIC is proving that paying your tax debt in full would create severe financial strain. To prove this, you must be willing to show the IRS facts. This could mean showing how your income barely covers necessary living expenses or how medical bills have drained your savings. The more detailed and transparent your hardship story is, the stronger your case will be. Cases that succeed often have detailed evidence, like medical bills, unemployment records, or other documents that validate the fact that things are very difficult.

3. Reasonable and Realistic Offer Amount

Here’s where a lot of people make their mistakes. They often attempt to offer less than what they are financially able to pay—a strategy that rarely succeeds with the IRS.

Submitting an offer that’s too low to be taken seriously can harm your chances. The IRS calculates your Reasonable Collection Potential (RCP)—essentially, the maximum they believe they could collect from you. Your offer should reflect this calculation, factoring in your disposable income, equity in assets, and basic living expenses. A reasonable offer signals good faith and shows that you understand the IRS’s expectations.

4. Compliance with IRS Filing and Payment Requirements

Before the IRS considers an OIC, it wants proof that you’re serious about resolving your tax problems. This means being up-to-date on all required tax filings and making estimated payments for the current year if applicable. Compliance shows the IRS you’re committed to staying on track moving forward, which can work in your favor when negotiating a settlement.

5. Persistence and Patience Throughout the Process

The OIC process isn’t quick—it can take months or even longer to finalize. Your success often lies in your ability to stay organized and respond promptly to IRS requests for additional information. It’s not uncommon for the IRS to come back with follow-up questions or require more documents. Being prepared and staying engaged shows the IRS that you’re serious and willing to see the process through.

6. Awareness of Eligibility and Pre-Qualification

Not everyone qualifies for an OIC, and applying without understanding your eligibility can waste time and resources. Tools like the IRS Pre-Qualifier tool can help you determine if you’re a viable candidate. Beyond that, knowing the specific factors the IRS evaluates—like income, expenses, assets, and liabilities—lets you tailor your application to meet their criteria.

7. Seeking Professional Guidance – The Role of Tax Lawyers in Resolving Tax Debt

We may have mentioned this last, but if you’re seriously considering getting an OIC, then your best bet is to seek professional help from the get-go. The OIC process is complex, and mistakes can be costly.

A skilled tax lawyer can make a huge difference by ensuring your case is presented effectively. They understand the nuances of IRS policies, know how to negotiate, and can advocate for your interests. Professionals can also spot issues early, helping you avoid missteps that might derail your application. Literally, professional guidance can be the difference between approval and rejection.

The Process of Applying for an Offer in Compromise

The first step in applying for an Offer in Compromise is to gather all necessary financial information. These include documenting your cash, investments, assets, income, debts, and household expenses. Note that the IRS uses this information to determine the minimum amount you’ll need to offer to settle your tax debt, so it’s important to be thorough and accurate.

The next step is to prepare and submit the OIC application. To do this, you’ll need to complete either Form 433-A (OIC) for individuals or Form 433-B (OIC) for businesses, along with supporting documentation like pay stubs, bank statements, and asset evaluation records. Also, if you’re married and filing separately, each spouse must complete their own form.

Double-check the documentation requirements outlined at the end of each Collection Information Statement (Forms 433-A and 433-B), as missing attachments could delay processing or lead to rejection. Next, you’ll complete Form 656, which outlines your actual offer to settle your tax debt.

Be sure to include copies, not originals, of these documents. Double-check the documentation requirements outlined at the end of each Collection Information Statement (Forms 433-A and 433-B), as missing attachments might be rejected or result in delay. Next, you’ll complete Form 656, which outlines your actual offer to settle your tax debt. Your application must include:

- A $205 application fee unless you qualify for Low-Income Certification.

- A down payment based on the offer option you choose:

- Lump Sum Offer: Pay 20% of the proposed offer upfront.

- Periodic Payment/ Monthly Payment Offer: Submit the first monthly installment upfront.

Make payments via personal check, cashier’s check, money order, or the Electronic Federal Tax Payment System (EFTPS). If your offer is denied, your payments are applied to your tax debt and generally aren’t refunded. The entire application package, including Forms 433-A or 433-B, Form 656, documentation, and payments, should be mailed to the appropriate IRS address.

Once submitted, the IRS will review your case and may request further information, so be sure to respond quickly. The next step involves IRS negotiation. For this process, it is advisable to work with a tax professional who can help you negotiate and present your case effectively.

Finally, you’ll need to monitor your application as the IRS evaluates your offer—this can take several months. If the IRS accepts your offer, you must strictly comply with all tax filing and payment requirements for the next five years to avoid defaulting. If your offer is denied, you can file an appeal using Form 13711 or explore alternatives like installment agreements or “currently not collectible” status.

During the process, penalties and interest continue to accrue. Any overpayments will be applied to your balance rather than refunded. Ultimately, success with an OIC depends on submitting a complete application, staying engaged with the IRS, and being realistic about your offer and ability to follow through.

How to Improve Your Odds of a Successful Offer in Compromise

Securing approval for an Offer in Compromise can be challenging, but with the right approach, you can significantly improve your chances of success. Here’s how to set yourself up for the best possible outcome:

1. Work With an Expert

The IRS has strict criteria for accepting an OIC. Given the high stakes, you cannot afford to make certain tax mistakes. A skilled tax attorney or enrolled agent can analyze your financial situation, identify key opportunities to strengthen your case, and ensure all the required forms and documentation meet IRS standards.

Moreover, they’ll act as your advocate. Should you encounter any IRS inquiries, they’ll address and present your case in the best possible light. This professional insight can be the difference between approval and rejection.

2. Be Transparent

When submitting your OIC, honesty is non-negotiable. Every figure and document you provide should reflect your true financial picture. Any discrepancies, even unintentional ones, can lead to delays, rejection, or worse—an investigation.

Make sure every figure in your application aligns with the supporting documents you provide, such as bank statements, tax returns, and pay stubs. The IRS evaluates your ability to pay based on the information you supply, so presenting a complete and accurate picture is essential.

3. Understand the IRS Evaluation Process

Before submitting your offer, familiarize yourself with how the IRS assesses applications. Knowing the eligibility criteria and how the IRS evaluates applications can help you tailor your offer to align with their expectations.

Some key points you should focus on include:

- How the IRS calculates your “reasonable collection potential” (RCP).

- What types of expenses are considered allowable?

- The documentation required for different types of applicants (individuals vs. businesses).

Knowing these will help you make informed decisions throughout the process.

4. Offer a Realistic Settlement

While it’s tempting to propose a rock-bottom offer, it’s crucial to ensure your settlement aligns with your financial ability to pay. The IRS won’t accept an offer that seems too good to be true—or too low to reflect your actual circumstances.

Calculate your RCP carefully, considering your assets, income, and expenses. If your financial situation changes during the process, update your offer accordingly. A reasonable, well-calculated offer is more likely to be accepted.

When an Offer in Compromise Might Not Be the Right Option

As reassuring as an Offer in Compromise might be, there are several situations where it might not be the right option. One such situation is when you can afford to pay your full tax debt. If your income and assets show that you can reasonably pay your federal or state tax debts through a lump sum or installment plan, the IRS is unlikely to accept an OIC. In this case, an installment agreement might be a better option.

Another instance is if you’re lagging on your tax filings. The IRS requires you to be up to date on all required tax returns before it will even consider your OIC. So, if you’re behind, you’ll have to first of all resolve the several years you’ve defaulted before applying for an OIC.

Also, the IRS will not consider an OIC if you are currently in an open bankruptcy proceeding. Bankruptcy courts usually handle debts separately, so you’ll need to resolve that first before considering applying for an OIC.

One more notable situation is when you can’t stay in compliance with all tax filings and payments for the next five years. If you expect to struggle with future tax obligations, an OIC could backfire, leading to default and reinstatement of the full debt.

If any of these is the case, you are not without options. You might qualify for an Installment Agreement, which allows you to pay your debt in monthly payments. And if you’re facing serious financial hardship, the IRS may place your account in Currently Not Collectible (CNC) status, meaning they temporarily stop all collection efforts till your finances improve.

There’s also a Partial Payment Installment Agreement, where you pay monthly, but not the full balance, and the rest may be forgiven later. These alternatives can provide relief without the strict rules and long processing time of an OIC.

Ready to Resolve Your Tax Issues With an Offer in Compromise?

If you’re a taxpayer unable to meet up with your tax debt, an Offer in Compromise may just be the lifeline you need. Provided that you prove your case, you can have a fresh start and the chance to rebuild.

If you feel that an OIC is the next step for you, contact us today for expert guidance or to schedule a free consultation. Let us help you take control of your financial future today! We can’t wait to make your story our next success story.

FAQ

Below are some common questions people are frequently asking about what an Offer in Compromise is and how to apply for it.

What Is the Average Success Rate for Offer in Compromise Approvals?

The IRS approves roughly 30% to 40% of Offer in Compromise applications each year, though this rate can vary due to economic conditions. According to NerdWallet, the IRS accepted 12,711 offers out of 30,163 submitted in 2023, which equals an acceptance rate of approximately 42.1%. This reflects a relatively strong approval rate compared to some past years.

How Long Does It Take for the IRS to Approve an Offer in Compromise?

It typically takes the IRS 6 to 12 months to review and decide on an OIC application. In some cases, it can take longer, especially if the IRS requests additional documents or if your financial situation is complex. During this time, the IRS pauses most collection activities, but interest and penalties may still accrue.

Why Do Some Offer in Compromise Applications Get Rejected?

Common reasons OICs are rejected include:

- The taxpayer can afford to pay through other means (e.g., an installment plan or selling assets)

- Incomplete or inaccurate forms and missing documentation

- The offered amount is too low

- The applicant is not current with tax filings

- The taxpayer is in active bankruptcy, which disqualifies them

- Rejections can often be appealed if you believe your case was wrongly denied.

What Happens After Your Offer in Compromise Is Accepted?

If your Offer in Compromise is accepted, you must follow specific conditions to keep the agreement in place. You’re required to pay the full agreed amount, whether as a lump sum or through monthly installments, and you must stay current with all tax filings and payments for the next five years.

During this period, you also cannot incur any new tax debt. If you fail to meet any of these conditions, the IRS can cancel your OIC and reinstate your full original tax debt, along with interest and penalties, effectively undoing the settlement.

Does Hiring a Tax Relief Company Improve My Chances of OIC Approval?

Hiring a reputable tax professional, such as a tax attorney, enrolled agent, or CPA, can improve your chances of getting an Offer in Compromise approved. This is especially true if you have complex finances, are unsure how to calculate a fair offer, or need help with documentation and negotiation.

These professionals understand how the IRS evaluates offers and can help you present a strong, well-supported case. However, not all tax relief companies are trustworthy. Some charge high fees while making unrealistic promises, including guaranteed acceptance, which no one can truly offer. It’s important to research any company you’re considering, check reviews, and be cautious of red flags before hiring help.

Who Has the Highest Success Rates for Offers in Compromise?

Generally, experienced tax attorneys and enrolled agents with a strong track record in tax negotiations have the highest IRS Offer in Compromise success rates. Firms like Victory Tax Lawyers are reputed to be successful in handling OIC cases.

What Are IRS Offer in Compromise Examples?

The IRS may accept low Offer in Compromise amounts if you can clearly show financial hardship. For example, someone with low income and high medical bills owed $25,000 but had their $1,200 offer accepted. A self-employed worker with unstable income settled a $60,000 tax debt with a $5,000 offer.

In another IRS Offer in Compromise example, a person who lost their job owed $15,000 and had their $800 offer approved after proving they couldn’t pay more. These IRS offer in compromise examples show that while low offers are possible, they must be backed by solid proof of your financial situation.