Owing taxes after the filing deadline means you have a tax debt with the Internal Revenue Service. And if it’s left unpaid, that debt can quickly grow with added interest and penalties. For both individuals and businesses, it can turn into a stressful situation, especially once the Internal Revenue Service starts taking action to collect.

This is where tax relief services come in. Tax relief services can help you navigate the complexities of IRS policies and programs and secure better outcomes. To do this, a tax professional first assesses your financial health and tax situation and then goes on to develop a suitable strategy to help you manage your debts without causing further financial strain.

Struggling with tax debt? Let us deal with the IRS while you focus on your life. Explore your tax relief options or schedule a free consultation with Victory Tax Lawyers today.

In this post, we’ll walk you through what tax relief means, how it works, and why working with a tax expert could be the smartest way to take back control of your financial future.

What Are Tax Relief Services?

Tax relief services refer to a range of policies or programs that lower your tax bills and make paying them easier. Essentially, these services center on helping people and businesses overcome their tax burdens and get back on solid financial ground. Tax relief measures include tax deductions and credits that reduce your tax debt as well as IRS programs that offer payment plans, partial forgiveness, or penalty relief for taxpayers facing financial hardship.

Different tax professionals can help you secure tax relief services, including tax attorneys, certified public accountants, and enrolled agents. These professionals have a deep understanding of tax laws and have the skills that equip them to deal directly with the IRS on your behalf and advocate for your best outcome.

Of course, you can certainly try to make some moves yourself, but advocating with the IRS to lower your tax liability or secure tax relief is not the easiest thing to achieve. However, with a tax relief company by your side, you’ll have someone who knows how to speak the IRS’s language and negotiate in your favor.

Common Problems Tax Relief Services Help With

A few of the most common issues tax relief companies deal with include:

1. Unpaid Back Taxes

Failing to pay taxes can lead to issues with the IRS that can snowball quite quickly. Interest and penalties begin to pile up, and eventually, what started out as a small tax bill can turn into a serious financial strain. Tax professionals help you sort through your tax bill, explore ways to reduce it, and determine a payment plan that fits your budget.

2. Tax Liens and Levies

When you ignore your back taxes for too long, the IRS may go as far as placing a lien or levy on your property. A lien communicates the government’s claim over your property to other creditors whereas a levy actually takes the property to satisfy the tax debt. Tax relief services can play a significant role in communicating with the IRS on your behalf and figuring out the best way to stop or reverse tax liens or levies if it has progressed to those.

3. Wage Garnishments

Wage garnishment means that the IRS withholds a part of your paycheck, leaving you with only a portion to get by. This is another consequence of ignoring your federal tax debt. Tax professionals help taxpayers stop garnishments and negotiate better options, such as payment plans or financial hardship status.

4. IRS Audits

Being audited by the IRS is never fun and requires expertise to address successfully. That is another aspect where the expertise of tax professionals is largely needed. If the IRS determines that your tax return needs to be audited, hiring an attorney to help you with audit representation is what you need to ensure you come out unscathed and that your rights are protected.

5. Penalties and Interest

Sometimes, the biggest part of your tax bill isn’t necessarily your actual unpaid taxes, but the added fees and fines that result from ignoring your tax obligation. As we already established, tax professionals can often request penalty relief or interest reductions, especially if you’ve had a valid reason for falling behind.

How Tax Relief Services Work

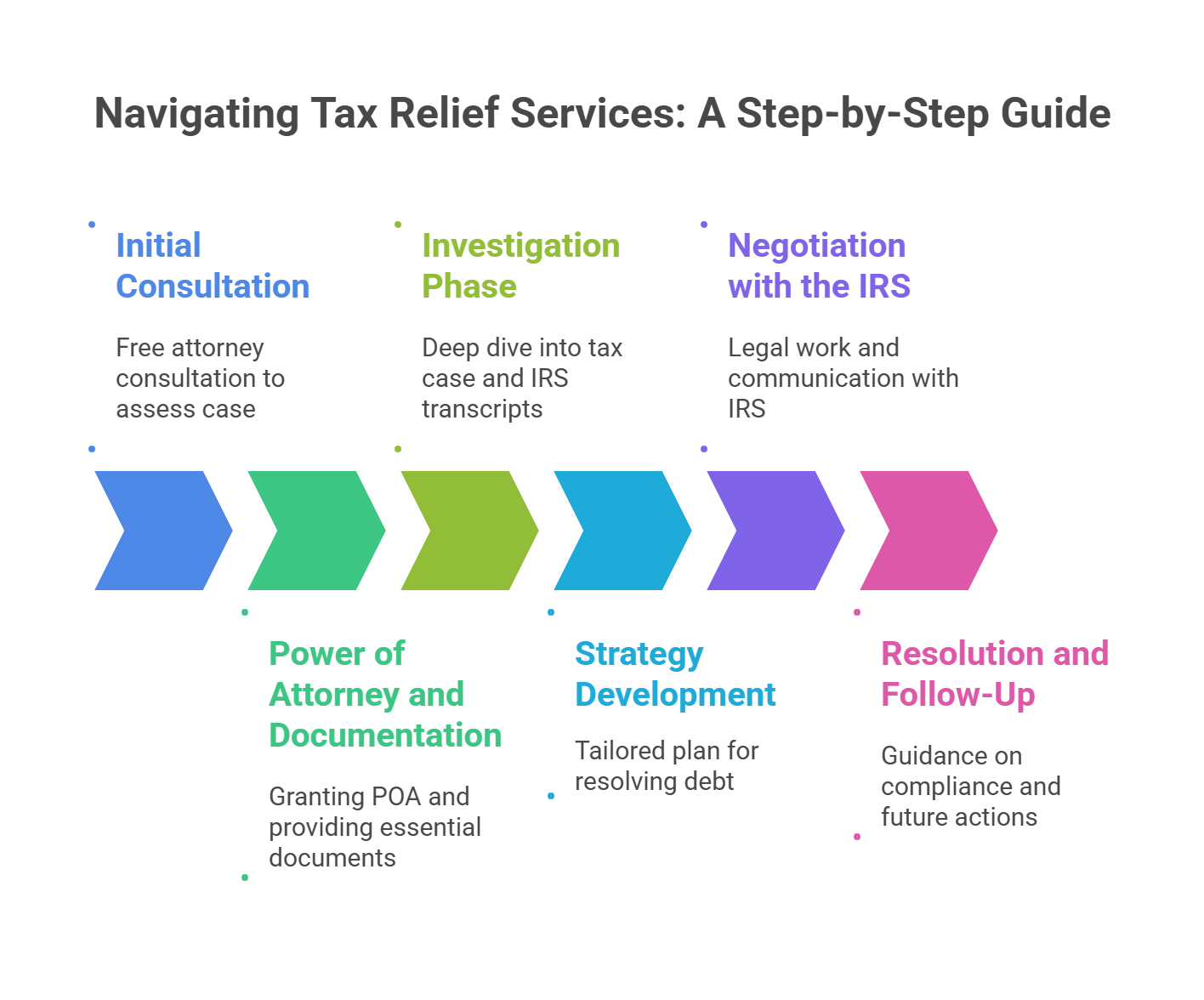

Tax relief services typically follow calculated steps designed to help taxpayers find the best possible resolution. Here’s typically how tax relief services work:

Step 1: The Initial Consultation

Everything starts with a consultation. Most reputable firms offer free attorney consultation, which lets you share details about your situation and ask relevant questions, and for the attorney to assess your case and determine whether tax relief can benefit you.

This stage gives the tax professional an idea of your financial standing and how to move forward. They’ll also walk you through the types of tax relief options and services they offer and the possible outcomes in your unique situation.

Step 2: Power of Attorney and Documentation

If you decide to move forward, you’ll need to grant the attorney Power of Attorney (POA). This refers to the legal authority to speak directly with the IRS on your behalf. You’ll need to provide essential documents like past tax returns, IRS notices, and financial statements (bank records, expenses, and pay stubs, etc.). These documents provide your representative with a clear picture of your financial standing, enabling them to build a solid case for relief.

Step 3: Investigation Phase

Here, the attorney commences a deep dive into your tax case. They’ll request transcripts directly from the IRS, verify how much you owe, and determine whether you comply with past filing requirements. This phase is all about gathering the facts and identifying the best possible routes to resolution, based on your unique tax situation.

Step 4: Strategy Development

Once the investigation is complete, your tax attorney will need to strategize and develop a tailored plan for resolving your debt. The strategy will depend on your current financial status, income, assets, and other eligibility factors. Some of the most common options include:

-

IRS Installment Agreements: An installment agreement, otherwise known as a payment plan, is an agreement with the IRS that allows you to make your tax payments within an extended timeframe if you believe you’d be able to clear your tax bill if you’re given that privilege. Essentially, the IRS directs you to make monthly installments until the unpaid taxes and the specified timeframe have elapsed.

-

Offer in Compromise (OIC): With an Offer in Compromise, the IRS agrees to you settling your tax debt for less than what you owe. An Offer in compromise (OIC) is one of the most difficult tax relief options to secure, which is why you need the expertise of a tax professional from the get-go.

-

Currently Not Collectible (CNC) Status: When you apply for CNC status, the IRS evaluates your situation first. If it deems you unable to truly meet up with your tax debt due to financial hardship, it then grants you CNC status. This temporarily pauses collection actions. However, it doesn’t stop penalties and interests from accruing.

-

Penalty Abatement: When you’re granted penalty abatement, the Internal Revenue Service agrees to reduce or remove some penalties if you can prove you acted in good faith and show reasonable cause for why you weren’t able to meet your tax payments.

-

Innocent Spouse Relief: If you filed a joint tax return with your spouse and are now dealing with the repercussions of their tax debt, you can request Innocent Spouse Relief. This relief protects those who have been unfairly held responsible for their spouse’s tax issues.

Step 5: Negotiation with the IRS

This is where the real legal work happens. The attorney submits the appropriate forms and documentation and handles all communications with the IRS. You may be wondering if a tax attorney can negotiate with the IRS. A tax lawyer specializes in this kind of representation, standing in for clients during conversations with the IRS. Having an expert who knows tax law and speaks the IRS’s language can make a huge difference in how your case turns out.

Step 6: Resolution and Follow-Up

Once a resolution is reached, whether it’s a settlement, payment plan, or another outcome, the attorney takes it up from there. They’ll guide you on staying compliant moving forward: filing your taxes on time, avoiding future penalties, and keeping the IRS off your back.

Common Types of Tax Relief Programs

The IRS doesn’t offer one-size-fits-all solutions — each option has its requirements, benefits, and limitations. Let’s explore the most common types of tax relief programs offered by the IRS.

Offer in Compromise Program

An Offer in Compromise is among the most popular IRS options and allows you to settle your tax debt for less than the total amount you owe. If you genuinely can’t pay the full balance without serious financial hardship, the IRS may agree to a reduced settlement. However, the IRS will carefully review your income, assets, and expenses to ascertain that you’re unable to pay your tax debt in full before accepting any offer.

Installment Agreements

Another option for taxpayers who can’t pay their debts in full is an IRS installment agreement. This plan lets you break your tax liability down into manageable monthly payments. It’s better suited for people who have a steady income but need time to catch up on their tax bills.

Currently Not Collectible (CNC) Status

If you’re in a tight financial spot and can’t afford to pay anything at the moment, you might qualify for Currently Not Collectible (CNC) status. This temporarily stops the IRS collection efforts, like wage garnishments or bank levies, and gives you time to stabilize your finances without added pressure.

Penalty Abatement

Sometimes, the penalties added to your tax bill are just as stressful as the tax debt itself. In some cases, you can request that the IRS remove or reduce those penalties through a Penalty Abatement. This works especially if you have a valid reason for falling behind, such as a medical emergency, job loss, or natural disaster.

Innocent Spouse Relief

For taxpayers facing tax debt as a consequence of their spouse’s actions, like underreporting income or claiming false deductions, they may not be responsible for paying that debt. Innocent Spouse Relief is created to protect you in such cases, provided you can present accurate documentation and a clear demonstration that you didn’t know when you signed the return.

Pros and Cons of Using Tax Relief Services

Hiring a tax relief service comes with its fair share of advantages and potential drawbacks. If you’re considering getting professional help, here are the pros and cons to keep in mind:

Pros:

-

Expert Guidance and Legal Support. Tax laws are complex, and mistakes can cost you. Having a licensed tax professional can put you ahead of the game.

-

Better Outcomes: Tax professionals understand what the IRS is looking for and how to present your case in the best possible light. They may help you secure the best possible outcomes.

-

Peace of Mind: Letting go of the stress that comes with dealing directly with tax agencies is a huge relief. Once your representative steps in, they handle the calls, the paperwork, and the negotiations, so you can focus on getting your life back to normal.

The Downside:

-

Cost: Professional tax help often comes at a cost. Some services charge flat fees, others bill by the hour and not all taxpayers can afford it.

-

Scams and Bad Actors: Unfortunately, some tax relief companies prey on people’s desperation, charging huge fees with little to no results. That’s why it’s always advisable to do your due diligence before hiring a tax expert.

-

No Guarantees: Even the best attorney can’t promise that the IRS will accept your offer or grant full relief. A reputable tax firm will be honest with you about what’s realistic and won’t make inflated promises.

How Much Do Tax Relief Services Cost?

What you pay for tax relief depends on various factors, including the complexity of your case, the type of professional you hire, and how long it takes to resolve the issue.

Generally, tax relief companies use one of two pricing structures: flat fees or hourly rates. Flat fees are common for specific services like filing an OIC or negotiating an installment agreement. You’ll typically pay a set amount upfront or in stages.

Hourly rates are more common when you’re working with a tax attorney or CPA on a case that’s more complicated or likely to evolve. Hourly rates can vary depending on the experience and location of the tax expert, but you’re often paying for specialized legal service that directly benefits your outcome.

Generally, the cost of a tax relief service ranges from $200 to $500 per hour or $2,000 to $10,000 for flat-rate services. A legitimate firm will be clear and upfront about its fees. So, if you sense any vagueness and it relates to fees, it may be a warning sign. Also, be careful with companies that promise to settle your debt for “pennies on the dollar.” If they make it sound like a guaranteed outcome before even asking relevant questions, they’re likely more interested in your money than your solution.

How to Choose a Reputable Tax Relief Company

If you’re considering professional help for your tax issues, choosing the right company can make all the difference. To find a reputable tax relief company:

Start with credentials

Although there are several different tax professionals, some may have more expertise to handle your unique tax situation. So, look out for someone who is legally qualified to represent you before the IRS, either a Certified Public Accountant (CPA), Enrolled Agent (EA), or licensed tax attorney. If you’re unsure about the difference between them, an EA, CPA, or tax attorney comparison breaks it down nicely.

Check their reputation

Some deep digging will always do you good. A company with a strong history, good ratings, and satisfied clients is far more likely to treat your case with care. Ensure to read testimonials from past clients with similar cases and check their standing with the Better Business Bureau (BBB).

Ask questions about fees

Before moving forward with any tax relief services, make sure you clearly understand how their fees work. Do they charge a flat fee or an hourly rate? Are there extra costs later? Do they have transparent pricing? A reliable company will carefully explain everything to you and won’t pressure you into paying before you’re comfortable.

Ask for a written agreement

When it comes to legal matters, documentation is key. A reputable firm will understand this and provide a formal agreement outlining what services they’ll provide, how much it will cost, and what you can expect. This sets clear expectations from the start and protects you.

Should You Hire a Tax Relief Professional?

If you’re struggling with tax debt, facing IRS notices, or just feeling unsure about how to move forward, you’re not without options. Each stage of the tax relief process, from the initial consultation and investigation to negotiation and resolution, offers a distinct advantage aimed at providing you with the best outcome.

You need the right help. Our team at Victory Tax Lawyers know how to win. We have some of the best tax attorneys with more than 10 years of experience and a trail of successful cases. If you’re looking to finalize that legal case promptly, contact us for a free consultation.

FAQs

Can anyone qualify for tax relief?

No. Although most taxpayers facing legitimate tax challenges are eligible for some form of relief, not everyone qualifies for every program. The IRS looks at your income, assets, expenses, and overall financial situation.

How long does the process take?

How long the tax relief process takes depends on the complexity of your case and the relief option you’re pursuing. Some cases, like simple installment agreements, can be resolved in a matter of weeks. An Offer in Compromise may take several months or longer, especially if additional documentation or negotiation is involved.

Is it better to go directly to the IRS?

You can definitely deal with the IRS directly and in some straightforward cases. However, more complex situations, especially penalties or audits, may require the skill of a licensed tax attorney. They understand how to navigate the system, avoid mistakes, and advocate for the best possible outcome.

Are tax relief services worth the cost?

They can be, especially if you’re facing serious tax issues such as audits, wage garnishment, or tax levies . A good tax relief firm can help you reduce your debt, stop enforcement actions, and avoid costly penalties.