Tax laws are anything but straightforward. Changing regulations, nuanced exceptions, and strict deadlines all contribute to its complexity, making it easier for people unfamiliar with the tax code to make errors. Usually, when faced with a tax case, the initial response for most is to try to handle it themselves, which may work for less complex concerns. However, when you’re dealing with bigger tax problems like fraud or growing IRS tax collections and penalties, the expertise of a tax professional is a non-negotiable advantage.

If you’re ever unsure of whether or not to hire a tax professional, ask yourself this: Can I deal with the consequences of getting my taxes wrong? The severity of your tax case should serve as a litmus test, letting you know what you can take on and what you shouldn’t. At the end of the day, the benefits of hiring a tax lawyer almost always outweigh the cost.

At Victory Tax Lawyers, one of our strong points is tax relief. We help our clients reduce their overalll tax liabilities while making sure they’re compliant with IRS rules and programs. With us handling your case, you can rest secure knowing that your case and the outcome to expect is guaranteed. Take advantage of our free consultation today and get the expert guidance you need.

This post explores scenarios when hiring a tax attorney is important, the situations where professional representation is most beneficial, and when you might be able to handle things on your own.

What Does a Tax Attorney Do?

A tax attorney is a legal professional who specializes in tax laws. As tax professionals, they study and have a deep understanding of tax codes, contract laws, and accounting rules. This knowledge enables them to guide their clients when it comes to all tax-related matters. Tax attorneys often have different expertise depending on their interests and area of specialization. Some specialize in corporate taxation, some in litigation, others in estate planning, and so on.

The key responsibilities of a tax attorney include:

- Representing clients during IRS audits: If you somehow happen to fall on the IRS radar for a tax audit, a tax attorney can advocate and make sure your rights are protected and not infringed on.

- Providing legal advice on tax matters: If you have a complex tax case on your hands, perhaps you’re facing collection actions, or you’re about to make a serious financial move that could impact your taxes, a tax attorney is who you need to speak to. With their help, you will better understand the tax nuances involved in your case and how to leverage the options at your disposal to secure for yourself the best possible outcomes.

- Handling tax disputes and appeals: You don’t always have to agree with the rulings and decisions of the IRS. If you disagree with an IRS ruling, you can contest it. A tax attorney can represent you in appeals, tax court, or negotiations with the IRS to achieve the most favorable outcome for your case.

- Assisting with estate planning and business tax structuring: A tax attorney can help you structure and compute your finances in a way that allows you to maximize available deductions, thereby reducing your eventual tax liability while also ensuring you’re in full compliance with tax laws. They can also help you set up trusts, draft wills, and handle everything related to your estate taxes.

Tax Attorneys vs. CPAs: What’s the Difference?

As long as you pay taxes, it’s important to understand the differences between a tax attorney and a CPA so you can choose the right professional for your needs. While their roles sometimes overlap in certain areas, their expertise and scope of services vary significantly.

Tax attorneys, as we already mentioned, specialize in the legal aspects of taxation since they generally have a deep understanding of tax laws, regulations, and their implications. On account of their expertise, they’re better suited to take on cases involving tax disputes; they’re also able to represent clients in litigation and advocate for them before the IRS. CPAs, on the other hand, are great at numbers. They’re highly skilled in the financial aspects of taxation, such as tax filing, bookkeeping, tax preparation, and financial planning.

A simple way to tell the two apart is this: CPAs are tax and accounting experts who focus on numbers, while tax attorneys specialize in legal tax matters. So when you think of tax filing or financial planning, a CPA is your go-to expert. But if you’re dealing with legal issues, IRS disputes, or need formal representation, a tax attorney is a better choice, since CPAs have limited expertise in those situations.

Cost vs. Benefit: Are Tax Attorneys Worth It?

Hiring a tax attorney is an investment, and like any investment, you want to make sure that the benefits far outweigh the costs. At first glance, it might seem counterintuitive to spend money on legal representation when you’re already dealing with tax debt or disputes. But hiring the right tax lawyer can save you far more in the long run, especially in complex or high-stakes tax cases.

Generally, the cost of hiring an IRS tax attorney varies depending on the attorney’s experience, their location, and the complexity of your case. Tax lawyers typically charge in one of three ways:

- Hourly rates: Their hourly rate often ranges between $200 to $500 per hour; highly experienced attorneys may charge more, though.

- Flat Fees: For specific services like an Offer in Compromise or responding to an IRS notice, their fees usually range between $2,000 to $10,000. On average, a tax attorney may charge between $2000 – $3500 for a simple IRS audit.

- Contingency Fees: Some other attorneys charge based on contingency, that is, based on a percentage of the amount awarded in the case. Since it’s often dependent on their ability to win the case, it’s a less common structure. Usually, this percentage ranges from 10% to 50%.

Irrespective of the amount a professional tax lawyer may charge, hiring one is almost always a wise financial move. The expertise of a tax lawyer can protect you from costly penalties, legal fees, or even time in jail if you’re dealing with fraud. Their ability to negotiate with the IRS to lower your debt or secure better payment terms can save you thousands of dollars in penalties, interest, and fees from the IRS.

That said, not every tax case requires the urgent legal intervention of a tax attorney. If you’re simply dealing with minor discrepancies or you need help with routine tax filing, a CPA is a great option to have on board.

Tax Attorney Costs vs. Consequences of Unresolved Issues

The cost of hiring a tax attorney isn’t static. It could vary based on many things, including your location, the lawyer’s expertise and experience, and even the complexity of your case. So, for example, it’s not uncommon to find tax lawyers in metropolitan areas such as California and Florida charging more than their counterparts in smaller rural communities.

When consulting with a tax attorney, remember to ask about their fees and pricing structure early and understand what services those fees cover so you don’t pile up surprises down the line. Nonetheless, while cost is an important factor, your primary focus should be on how a tax attorney can help you resolve your tax issues, especially if you’re already facing or on the brink of facing federal tax liens, levies, or IRS wage garnishments.

What Happens if You Don’t Get Help?

Getting expert advice sooner rather than later is always a smart move. The longer you wait, the more complicated—and expensive—your tax situation can become. Here are some risks you take when you don’t seek professional help:

- Penalties and Interests That Keep Growing: The IRS doesn’t just send a bill and forget about it. When you fail to pay your taxes, penalties and interest start adding up fast—and they don’t stop. For example, failing to file your return on time can result in a penalty of up to 5% of your unpaid taxes per month. If you don’t pay up after that, another 0.5% penalty kicks in each month. Soon enough, you may be having to deal with tens of thousands of dollars in penalties and interest.

- Levies and Wage Garnishments: Unresolved back taxes and not responding to IRS notices can quickly spiral into the IRS issuing a levy or garnishing your wages. When the IRS files a levy on your account, they’re given the right to seize your assets, including your car, bank accounts, and even your retirement savings. When they garnish your wages, they’re able to take a large chunk of your paycheck. In both cases, you’re at risk of losing what you’ve worked hard for.

- Criminal Charges: Most IRS issues are civil cases, but in extreme cases, you may have criminal litigation on your hands. Tax fraud, tax evasion, and underreporting your income are just a few examples of ways you could have the IRS coming at you for criminal charges. If you’re convicted, you could face hefty fines and even jail time. Aside from the obvious stress that comes with criminal charges, the long-term impact on your reputation is another hassle.

- Emotional Stress: Beyond the financial and legal risks, there’s also the mental and emotional toil that comes with dealing with the IRS. You’re constantly looking over your shoulder, worrying about IRS notices, audits, the fear of losing all you’ve worked for, and the uncertainty of what each day may bring your way. You do not don’t want to have to deal with all of that. The longer you wait, the worse it gets—and the harder it becomes to dig yourself out.

A skilled tax attorney can intervene before things get out of hand. In many cases, they can help you negotiate a penalty abatement. That means getting your penalty removed if you demonstrate that you had a “reasonable cause” for filing your tax obligations or paying late. They can help you set up manageable payment plans, seek relief where possible, and help you stay out of trouble subsequently. Victory Tax Lawyers has the best team to get you the best possible outcomes on your tax liabilities. If you’re struggling with tax debt, liens, or penalties, we’re here to help you out.

Benefits of Hiring an Experienced Tax Lawyer

There are several advantages to working with a tax attorney. From the peace of mind that comes with knowing a professional is handling your case to the strategic edge their legal expertise provides, their support can make a significant difference. Here are some benefits you can expect when working with an attorney:

1. Legal Expertise

Tax laws are constantly being updated, making it almost impossible for just anyone to keep up with the new changes. Beyond this, interpreting the tax code is a lot of work. Luckily, tax lawyers are experts at that.

Experienced tax attorneys have in-depth knowledge of these laws and know how to interpret and apply them to your unique situation. If you’re dealing with back taxes, audits, or tax disputes, an attorney’s legal expertise is what you need to make the right decisions and protect your interests.

2. Confidentiality and Attorney-Client Privilege

Tax matters are inherently sensitive, especially if you’re at risk of legal action. Hiring a tax attorney can help safeguard your privacy, which may be lacking if working with an accountant, as tax attorneys are required to provide full confidentiality under attorney-client privilege. This means that anything you disclose to your attorney remains protected, even in the event of an IRS investigation or legal proceedings. It’s not the case with your CPA or tax preparer. They can testify against you in court if they are required to.

3. Negotiation Skills

Dealing with the IRS can prick at your confidence. It’s even more difficult when you’re facing a problem that leaves you at the mercy of their ruling. Such as when you’re dealing with a tax dispute, penalties, or aggressive collection actions. A tax attorney brings a big advantage in these situations—the ability to negotiate for you.

Since they are trained in legal advocacy and negotiation, they know IRS procedures, how to present a strong case, and can explore settlement options like Offers in Compromise or installment agreements. Their negotiation skills can go a long way in securing favorable outcomes for you.

4. Mitigating Risks

Tax mistakes rarely leave you without legal and financial burdens to deal with. Working with a tax attorney saves you from costly mistakes that may impact your financial future. With their personalized guidance, you can avoid consequences and penalties.

8 Situations When Hiring an IRS Tax Attorney Makes Sense

When it comes to tax-related matters, it can be difficult to decide whether to hire a tax attorney, a CPA, or a tax preparer. Here, we’ve outlined several situations to help you know when to hire a tax attorney:

1. When Setting up IRS Payment Plans

Although installment agreements are an option with the IRS for resolving certain tax issues, it’s not available to everyone. A knowledgeable and experienced tax attorney can help you check if the option is available to you. And even if it’s not, the IRS offers different payment plan options depending on how much you owe and how long you need to repay your debt. They can guide you in securing other payment plans that can reasonably reduce your tax obligation.

In addition to helping you negotiate the best possible payment plan, they follow up with you to ensure compliance with IRS requirements during the payment process.

2. When You’re Facing an IRS Audit

Business owners aren’t the only ones who can be audited by the IRS. Audit notification can come knocking at your door at any time. The process often starts with an initial interview where the IRS asks a series of detailed questions. Your response can significantly determine the direction of the audit and, in some cases, even lead to a referral to the IRS Criminal Investigation Division (CID).

Nearly half of all cases flagged for potential fraud often come from that first initial interview. With a tax attorney by your side, you don’t have to worry about saying the wrong things. A tax attorney can also offer audit representation during the audit process and negotiate on your behalf. More so, they can guide you in appealing some of the actions taken by the IRS, resulting in a more favorable outcome at the end of the day.

3. If You Owe Significant Back Taxes

The IRS keeps a close eye on you if you owe back taxes. And yes, they can be unrelenting when it comes to tracking down those on their record. The agency has a range of assertive collection tactics, from wage garnishments to bank levies, and many more. This is why you must address whatever issue you may be facing before it gets worse.

If you owe back taxes, hiring an experienced tax attorney can help. They can review your case, correct any past filing errors, and negotiate directly with the IRS to secure a manageable resolution. Whether it’s penalty abatement, setting up an installment agreement, or pursuing tax relief options, an attorney’s tax knowledge can come in handy and help you resolve your tax debt.

4. To Resolve Tax Liens and Levies

IRS liens and levies are some of the most serious consequences of failing to pay your taxes, and once they’re in place, they can cause problems that throw your finances off balance. A tax lien can damage your credit and make it difficult and almost impossible to secure loans, while a levy grants the IRS the right to seize your assets.

Our tax attorneys can help you negotiate with the IRS to ease you of the burdens of levies and liens so you can regain control of your finances. Contact us today at no cost.

5. When Negotiating an Offer in Compromise (OIC)

If you’re facing the problem of tax debt and are thinking of requesting an Offer in Compromise (OIC), then you might need the services of a tax lawyer. The IRS hardly offers compromises to anyone, and the process is just about as burdensome as it can be.

A tax lawyer can help you determine your eligibility before applying, meet the IRS eligibility criteria while applying, prepare the required documentation necessary for approval, present a strong case to significantly lower your tax debt, and increase your chances of securing approval.

6. If You’re Accused of Tax Fraud or Evasion

Tax fraud or evasion occurs when a person intentionally avoids paying taxes, whether by underreporting income, inflating deductions, or failing to file returns. The IRS doesn’t take these offenses lightly. It goes without saying that once you have an IRS case related to tax evasion or fraud, you need to hire an attorney immediately.

While other tax problems merely attract penalties and fines, you’re at risk of imprisonment when you evade taxes. If you’re facing accusations of tax fraud, a tax attorney can help you present a solid defense to challenge the IRS’s claims. They can help differentiate between intentional fraud and a mere honest mistake, keeping you on the less severe side of the law. If your case is at risk of becoming a criminal investigation, a tax lawyer can intervene early by helping you negotiate with the IRS before it leads to prosecution.

7. When Dealing with International Tax Issues

When you extend your business operations into multiple states or countries, you significantly complicate your tax obligations. Without proper planning, you might have to deal with double taxation, surprise liabilities, or penalties for not complying with specific tax laws, even if you were ignorant of those laws. A good tax attorney guarantees that your business maintains compliance with the necessary reporting requirements of the country where you’re operating.

For expatriates running a business in the United States, a tax lawyer can develop and implement the right strategies to help with your operations. Since tax obligations are often dependent on the business structure, an experienced attorney can guide you on how to structure your entity to avoid unnecessary taxes while remaining fully compliant with U.S. and international tax laws.

8. Corporate Tax Issues

Corporate taxes can be a nightmare without proper management. And when left unchecked, tax concerns can spiral into a host of other complex problems. A tax attorney will help you stay abreast and compliant with all the relevant federal tax laws and local tax laws that relate to you and are relevant to your business. Moreover, they can provide you with guidance on operational structuring, tax-efficient mergers and acquisitions, and other strategic decisions that affect your company’s financial health.

Many businesses encounter difficulties when it comes to establishing an effective tax management framework. The right tax management framework will help you minimize liabilities, prevent penalties, and maximize all available tax-saving opportunities, and a tax attorney can help you with all these.

Tax Problems Where You Might Not Need a Tax Attorney

In some cases, a CPA, tax preparer, or enrolled agent may be all you need to handle the situation. Here are cases where you don’t necessarily need to hire a tax attorney:

- Simple Tax Filing or Basic Tax Prep – If you have straightforward tax needs, such as filing annual returns or claiming deductions, a CPA or tax preparer can assist you.

- Minor Tax Discrepancies – If the IRS sends you a notice to draw your attention to a minor miscalculation or a missing document, you don’t need to run off looking for a tax lawyer. In many cases, responding to the IRS with the correct information or paying a small penalty resolves the issue.

- No Risk of Legal Trouble – If you’re not under audit, facing significant debt, or involved in litigation, you may not need an attorney. If you owe the IRS a manageable amount and need more time to pay, you can request an Installment Agreement (IA) on your own or with the help of a CPA.

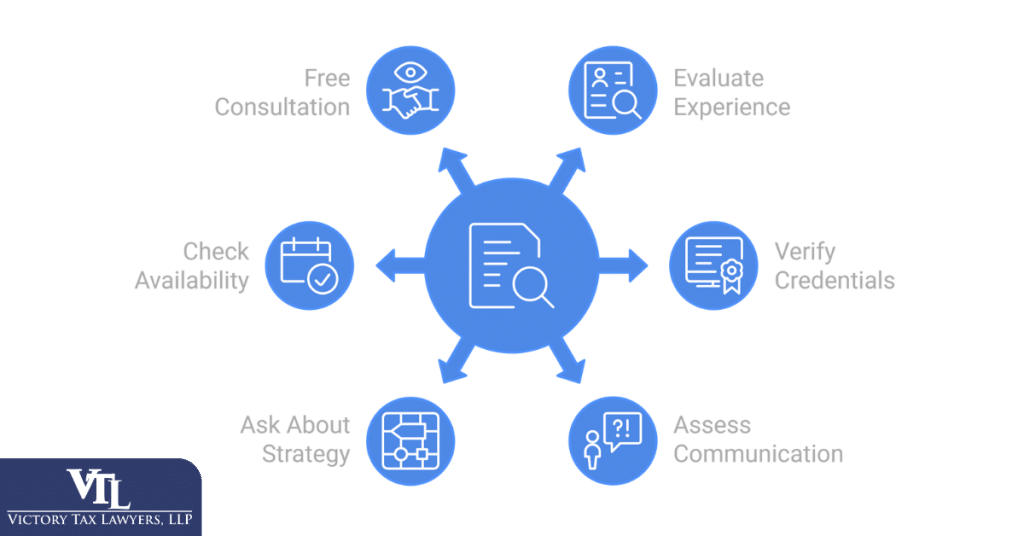

How to Choose the Right Tax Attorney

Selecting the right tax professional is an important first step to making sure your taxes are filed correctly. With the long list of attorneys out there, choosing the right attorney can be tricky. Here is a guide to help you make an informed choice:

1. Evaluate Their Experience and Expertise

Experience and expertise come second to none when choosing a tax attorney. Tax law is broad, and as we mentioned earlier, attorneys often choose to focus on specific areas. If you’re dealing with an IRS audit, for example, an attorney experienced in audit defense and representation will be more beneficial than one whose expertise is in estate taxation. Don’t just take their word for it; ask for references, client testimonials, reviews, or case success rates.

You can ascertain their experience and expertise from peers in the legal and business community. Some places to begin include Yelp, Avvo, the Better Business Bureau, Google Business Profile, Justia, etc. A well-respected attorney will most likely have strong relationships with IRS officials, accountants, and other professionals. These relationships can come in handy when negotiating settlements or resolving tax disputes.

2. Know Where to Look

Start your search on your state’s bar association website. Many of these websites offer directories to help you sort by practice area, letting you see if the attorney has proper credentials and focuses on tax law.

Ask friends, family, or coworkers who’ve worked with tax attorneys for suggestions. If you have a financial advisor, they might offer helpful recommendations too. Even with suggestions, always make sure to check things out yourself.

3. Verify Credentials

Before hiring a tax attorney, confirm their professional qualifications. Find out if the attorney has a law license, which permits the attorney to practice law in your jurisdiction. You can verify this information on your state’s bar website.

Additional credentials, such as a Certified Public Accountant license [CPA], also give tax attorneys an edge. If you’re looking for an attorney to help you with tax returns, ensure they have a Preparer Tax Identification Number (PTIN) from the IRS. These credentials show their ability to take up tax cases with both legal and financial expertise.

4. Assess Communication Skills

Work with a tax attorney who prioritizes clear and effective communication. A good attorney must know how to follow up with clients, keep them updated on any developments as the case progresses, explain complex legal matters in a way they can understand, and clear up their confusion at any point.

5. Ask About Case Strategy

A professional tax attorney usually has a clear legal strategy and approach to clients’ cases. Since every tax issue is different, a generic, one-size-fits-all approach may not necessarily deliver the best results. This is why you should choose an attorney willing to spend time understanding and developing strategies tailored to your situation.

6. Check Availability

Ask about the tax attorney’s availability. If they are juggling too many cases, they might not be able to dedicate enough focus to yours, even if they’re top shots. You want an attorney who has time for you, who can give your case proper attention, respond to your concerns, and work with your schedule and needs.

7. Look for a Free Consultation Option

A free consultation gives you the chance to speak with your potential tax attorney and assess them to see if they’re the best fit for your case. Be sure to use the free consultation to learn as much as you can. Ask key questions such as the types of tax cases they handle, if they’re licensed, and where they are licensed to practice, what their billing structure and fees are like, and any other questions that you think may enable you to gauge their fit for your case.

Need a Trusted Tax Attorney to Resolve Your Issues?

Navigating the tax terrain may seem relatively easy on paper, especially with the countless online tools and articles offering tax advice. But in reality, the tax code is anything but straightforward. Without expert guidance, it’s easy to make costly mistakes or unknowingly violate tax laws. Because tax attorneys are trained to interpret the tax code and understand the law, they’re in the best position to help you manage your tax obligations. Hiring a professional tax attorney isn’t just a smart move—it’s a cost-effective way to handle your taxes.

Our team of experienced tax attorneys at Victory Tax Lawyers specializes in solving IRS problems, from back taxes and audits to liens and levies. We’re passionate about helping our clients deal with the daunting IRS process, which is why we offer clear guidance and effective solutions tailored to your unique situation. Book a free consultation with us or visit our office today to speak with our tax lawyers.