Ever heard the phrase “No free lunch even in Freetown?” It’s especially fitting when it comes to employee benefits. Most people assume that when they receive benefits from their employer, they should come tax-free, because what’s the point of an add-on if you still have to pay for it? Well, that’s not always the case.

Employee benefits are subject to specific IRS rules that determine whether they’ll be taxed or not. The IRS categorizes benefits into two types: taxable and non-taxable. Taxable benefits count as part of your income and are, therefore, taxed. Non-taxable benefits, on the other hand, are considered tax-exempt.

Facing a tax bill tied to your benefits? Let Victory Tax Lawyers step in. We help individuals and employees resolve complex tax situations with strategic, attorney-backed solutions. Learn more about your tax relief options or book a free consultation.

In this article, we’ll go over what employee benefits are, how they are taxed, which benefits are considered tax-exempt, and how you can minimize the impact of taxes on employee benefits.

What are Employee Benefits?

Employee benefits are various forms of non-salary compensation given to workers on top of their usual pay or wages. Some common examples of these benefits include Healthcare coverage (medical, dental, vision), retirement plan contributions (such as 401(k) or pension plans), tuition assistance or educational reimbursement, transportation or parking benefits, and employer-paid life insurance.

Most companies provide some form of mandatory and secondary benefits to their workers, depending on their size and financial capacity. They provide such benefits primarily to increase job satisfaction, retain top talent, and attract the right hands to the company. Sometimes employee benefits are monetary, while at other times they’re not, depending on how the compensation package is structured.

Non-monetary benefits are commonly referred to as fringe benefits or benefits-in-kind. While these benefits are typically non-monetary, they often have an assignable, measurable monetary value that becomes relevant for federal income tax purposes.

According to the IRS, “any fringe benefit provided is taxable and must be included in the recipient’s pay unless the law specifically excludes it.” In essence, certain fringe benefits are subject to Federal Income Tax Withholding and employment taxes, while others aren’t. This brings us to an essential distinction every employee should understand: taxable vs. non-taxable benefits. Some benefits are added to your income and taxed just like your salary. Others are exempt, giving you a tax cut. You need to know the difference between the two so that you can always plan smartly and report your taxes accurately.

Taxable vs. Non-Taxable Employee Benefits

As we already mentioned, not all employee benefits are tax-free. The IRS categorically distinguishes between taxable and non-taxable benefits. As an employee trying to plan or an employer working on benefits options, you need to understand the law’s position on the benefits in question. Not knowing this difference can result in surprise tax bills or even problems with compliance.

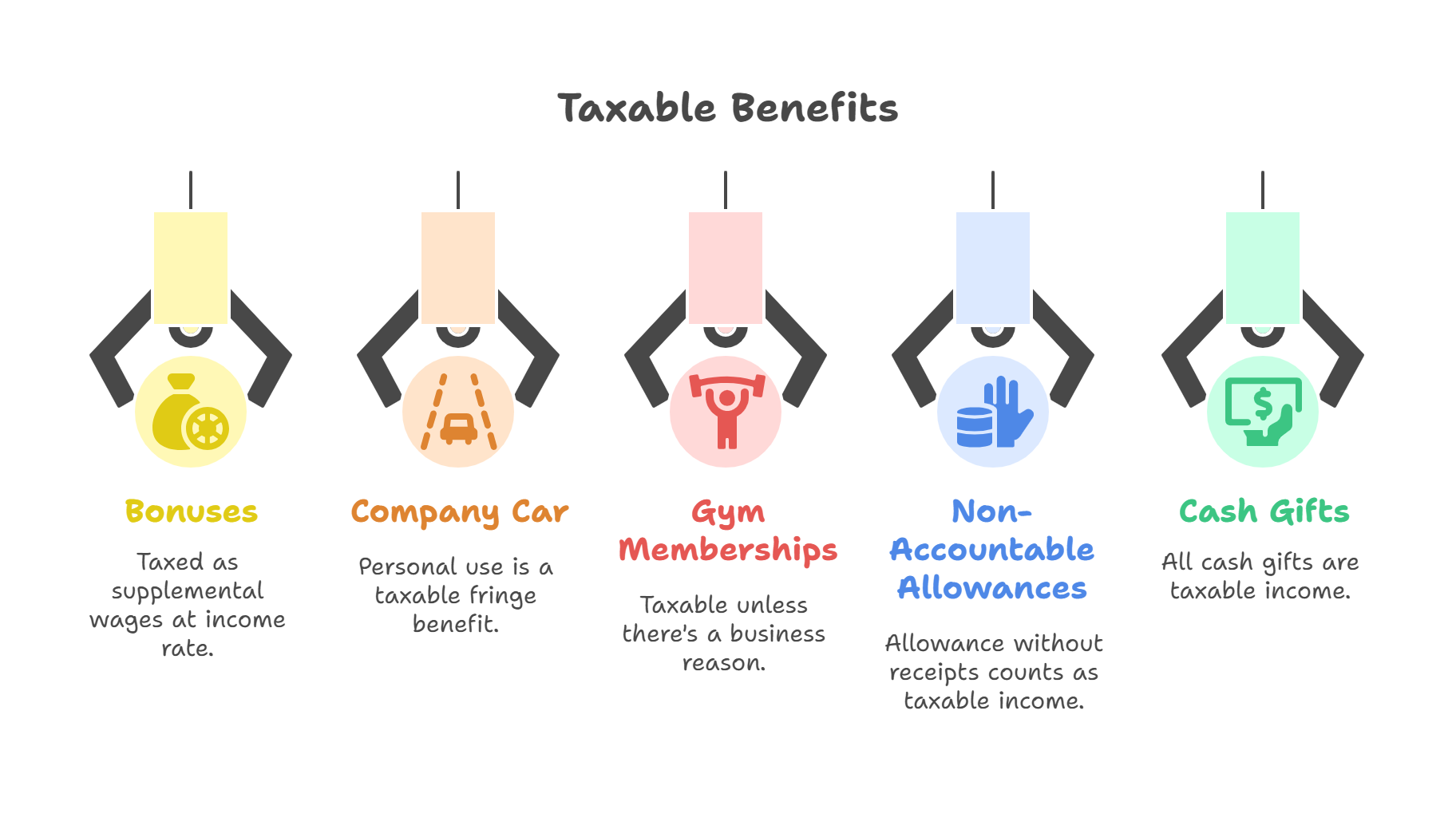

Taxable Benefits

Taxable benefits are any perks or compensation the IRS treats as income, meaning you’ll owe taxes on their value. They must be reported on your annual tax return and are typically included in your Form W-2. There are several of them, and how each item is taxed varies:

1. Bonuses and Incentive Awards

The IRS treats these as supplemental wages, and hence, they are taxed at your ordinary income tax rate and are generally subject to withholding at a flat supplemental rate.

2. Personal Use of a Company Car

If you’re given a car at work, which you sometimes use for personal errands or commuting, that personal use is considered a fringe benefit in tax law. Fringe benefits are considered taxable. In the case of a company car, the taxable value is determined by either the Annual Lease Value Method or the Cents-Per-Mile Rule, depending on how the employer reports it.

3. Gym Memberships

Employer-paid gym memberships are taxable unless there’s a bona fide business reason why you should have a gym membership. For example, if there’s an on-site gym meant to make employees’ workday efficient, the rule might not apply.

4. Non-Accountable Allowances

If you get an allowance to cover things like travel or meals but don’t have to provide receipts or proof of spending, the full amount counts as taxable income.

5. Cash Gifts and Gift Cards

The IRS treats all cash gifts or gift cards, even the meager ones, as taxable income you must report. If you’re not sure whether or not a benefit is taxable, don’t assume. Ask your HR department for the documentation your employer files with the IRS, because while your employer may be responsible for reporting your taxable benefits, the burden of confirming the reported income falls on you.

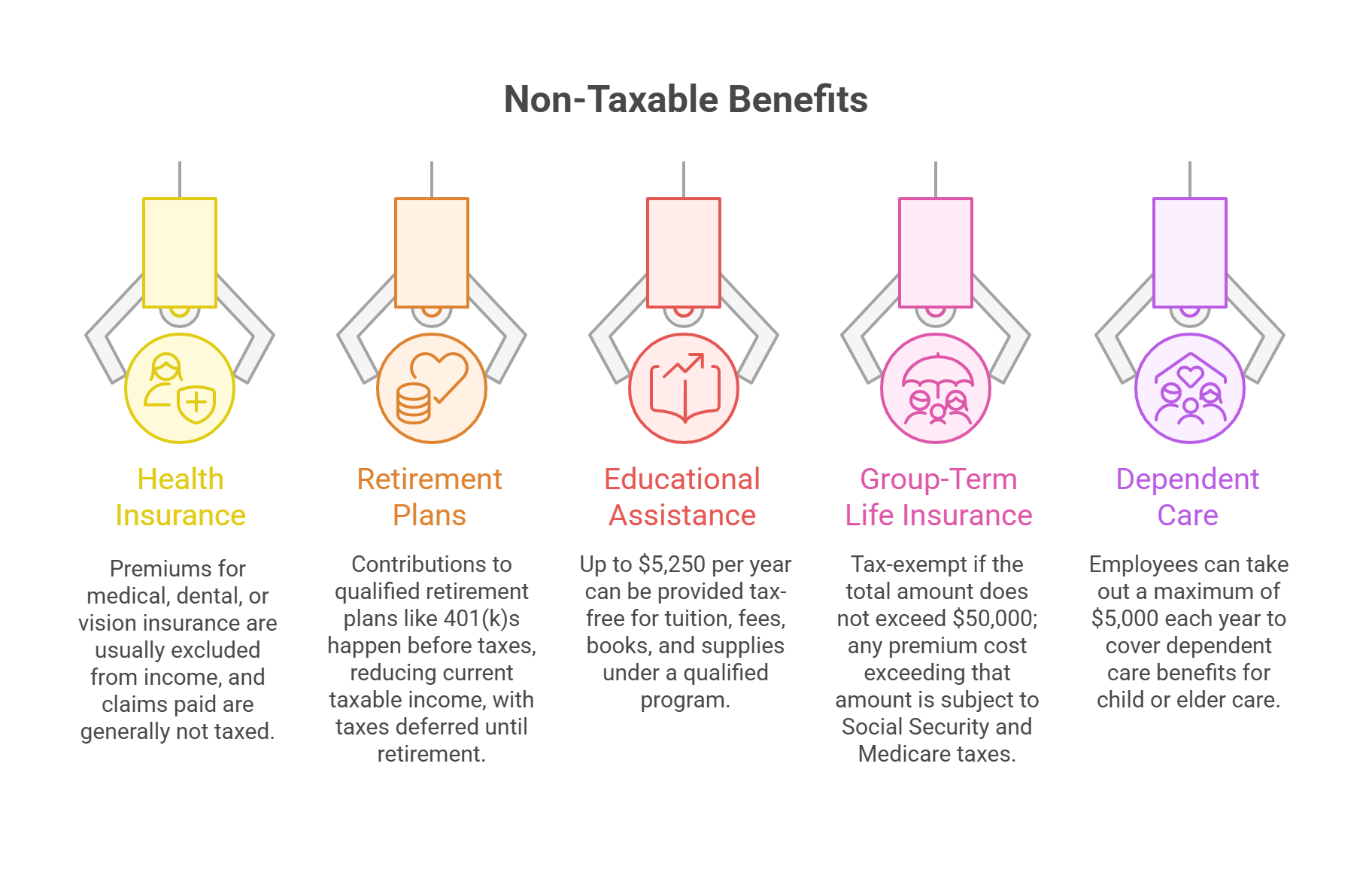

Non-Taxable Benefits

These are benefits that aren’t considered income and, hence, are not subject to taxes. In essence, they enhance your compensation package but leave you without the extra liability. Examples include:

1. Employer Contributions to Health Insurance

In most cases, employers cover the premiums for medical, dental, or vision insurance, and these benefits are usually 100% excluded from your income. You also generally don’t pay tax on claims paid by the insurance.

2. Employer Contributions to Qualified Retirement Plans

Contributions to things like 401(k) happen before taxes are taken out, which reduces your current taxable income. Moreover, the taxes are usually deferred until you’re ready to withdraw your funds during retirement.

3. Educational Assistance:

By law, up to $5,250 per year can be provided tax-free for tuition, fees, books, and supplies under a qualified educational assistance program.

4. Group-Term Life Insurance

According to the IRS, these are tax-exempt if the total amount does not exceed $50,000. Any premium cost for coverage that exceeds that amount automatically becomes subject to Social Security and Medicare taxes.

5. Dependent Care Assistance

Employees can take out a maximum of $5,000 each year to cover dependent care benefits if it’s used to pay for child or elder care.

Special Categories and Complex Benefits

Some benefits neither fall under the taxable nor the non-taxable benefits buckets. Examples include:

- Deferred Compensation: This is an arrangement in which a portion of your income is withheld for payment at a later date. Deferred comp is generally taxed when it eventually becomes accessible to you, not at the time you earn it. Examples are non-qualified deferred comp plans.

- Equity-Based Compensation (RSUs, Stock Options): The IRS taxes Restricted Stock Units (RSUs) as ordinary income when they vest, based on fair market value. Stock options may be taxed when they are either exercised or sold. It ultimately depends on whether they are incentive stock options (ISOs) or non-qualified options (NSOs).

- Expense Reimbursements: If your employer pays you back for work-related costs under an accountable plan, the reimbursements are considered tax-deductible. If the reimbursements are made under a non-accountable plan, however, they are treated as taxable income.

- Flexible Spending Accounts (FSAs, HSAs): Contributions to FSAs and HSAs are made before taxes are paid, hence they reduce your taxable income. Having said that, any non-qualified distributions from these accounts will be taxed and may even trigger penalties.

- Employer-Paid Health Insurance Premiums: Premiums covered by your employer for health insurance are generally considered non-taxable. However, if your employer pays for non-qualified coverage or additional premiums beyond standard plans, those extra amounts might end up being taxed.

Valuation of Non-Cash Benefits

It’s easy to place a taxable value on cash benefits. But how about when you have non-cash perks or benefits-in-kind? For example, if you drive a company car, how do you determine its taxable value? Luckily, the IRS has issued detailed valuation methods to guide you:

- Fair Market Value: In finance, the fair market value of an asset refers to the price you would have to pay if you were buying the benefit yourself on the open market. It’s one of the most commonly used methods of asset valuation. For instance, if a benefit were valued at fair market value, say your employer gives you free event tickets, the taxable value would be what those tickets would normally cost. The IRS or the relevant tax agency typically provides guidelines for determining the fair market value of such benefits.

- Uniform Premium Table: This is a chart the IRS provides to calculate the taxable portion of group-term life insurance when your employer provides coverage over $50,000. You can refer to the table to determine the monthly cost per $1,000 of extra coverage for your age bracket. That amount is considered a fringe benefit and is seen as taxable income.

- Special Valuation Rules: These are special formulas the Internal Revenue allows for certain benefits, so you don’t have to guess the value. For instance, Company Cars uses the Annual Lease Value Table to determine the taxable portion based on the car’s age and value. Employer-Provided Housing uses IRS guidelines to calculate how much of the housing benefit counts as taxable income. De minimis (Low-Value) Fringe Benefits, which include small perks such as occasional meals or holiday gifts under a certain threshold, are often not taxed.

How to Minimize the Tax Impact of Employee Benefits

While the taxation of employee benefits is largely dictated by tax laws and regulations, there are strategies you can employ to minimize the tax implications on your benefits:

- Maximize pre-tax contributions: Consider contributing to your retirement accounts (such as a 401(k) or HSA) or health savings accounts (FSA) to reduce your taxable income.

- Choose benefits with lower taxable value: If you’re given the option to choose, go for benefits that aren’t added to your taxable income or at most have a lower taxable value.

- Monitor your taxable fringe benefits: Keep track throughout the year of the benefits that contribute to your taxable income, so you’re not blindsided during tax time.

- Stay informed: Tax laws are always changing- sometimes it’s minor changes here and there, and other times, it’s significant changes that affect you and how you conduct your tax obligations. Even minor updates in the tax law can have significant repercussions when ignored. So stay updated and informed so you’re always in line.

- Talk to a tax expert: A tax expert is one ally who would save you time, money, and stress. If you’re not that great at managing your taxes yourself, and many people aren’t, talk to an expert, especially if you receive stock options, deferred comp, or other complex benefits.

Are 401(k) Contributions Taxable?

Named after a section of the Internal Revenue Code, the 401(k) is a retirement savings plan widely available to qualified employees in the United States. It offers tax advantages that incentivize individuals to save for their post-working years. While these tax advantages are clear, there’s often confusion surrounding the taxation of contributions to these plans. Let’s look into the intricacies of 401(k) contributions and their tax implications.

The 401(k) retirement savings plan is sponsored by employers, allowing workers to set aside a portion of their earnings before taxes are deducted. Taxes are only applied when funds are taken out of the account.

There are two primary types of 401(k) plans:

- Traditional 401(k): Contributions are made pre-tax, reducing an individual’s taxable income for the year they contribute. Taxes are then paid upon withdrawal.

- Roth 401(k): Contributions are made with after-tax dollars. While there’s no immediate tax break, the withdrawals in retirement are tax-free.

Tax Benefits of 401(k) Contributions

1. Immediate Tax Reduction – When an employee makes contributions to a traditional 401(k), those contributions are taken out of their paycheck before any taxes are applied. As a result, the amount they contribute directly reduces their taxable income. To illustrate, if an individual has an annual salary of $60,000 and deposits $5,000 into their traditional 401(k), their reported income for taxation would be $55,000.

2. Tax-Deferred Growth – Funds added to a 401(k) enjoy tax-deferred growth, meaning that earnings like dividends, interest, or capital gains aren’t taxed until withdrawn. This benefit allows the money to grow and compound faster than in accounts where taxes apply immediately.

3. Tax-Free Withdrawals for Roth 401(k) – With a Roth 401(k), while your contributions are taxed, your withdrawals during retirement are entirely tax-free, provided you meet the necessary conditions laid out..

Tax Implications at Withdrawal

When you take money out of a traditional 401(k) after retiring, the government taxes it as regular income. For Roth 401(k) distributions, they are tax-free as long as the account holder is at least 59½ years and the account has been open for at least five years.

That said, it’s important to understand the potential penalties that apply if you withdraw too early. Taking money out before age 59½ typically triggers a 10% early withdrawal penalty on top of regular income tax, unless you qualify for exceptions like disability or significant medical expenses.

Once you hit age 72, Required Minimum Distributions (RMDs) kick in for traditional 401(k) accounts. These are mandatory annual withdrawals calculated based on your life expectancy and account balance. Failing to take them can result in hefty penalties.

How to Maximize the Tax Advantages of a 401(k)

To get the most out of the tax advantages of a 401(k):

- Contribute Enough to Get the Employer Match: Many employers offer a match to employee contributions. This is essentially free money and a guaranteed return on investment.

- Consider Roth vs. Traditional: If you think taxes will be higher when you retire picking a Roth 401(k) could help with tax-free withdrawals later on.

- Avoid Early Withdrawals: To avoid penalties and give room for your investments to grow, you want to avoid withdrawing your funds too early.

- Stay Informed: Tax laws and regulations can, and does change over time. Staying updated with the latest changes can help you make informed decisions about your retirement savings.

Need One-on-One Guidance on Taxation of Employee Benefits?

From understanding the nuances of 401(k) contributions and employer-paid life insurance premiums to the complexities surrounding educational assistance, the taxation landscape of employee benefits is multifaceted. Each benefit comes with its own set of tax implications that can significantly impact an individual’s financial situation. Some benefits are tax deductible, others aren’t, and it’s important you understand these distinctions.

If you’re not really clear on what the law stipulates, this is where the expertise of a tax lawyer becomes invaluable. Whether you need help understanding your obligations or resolving an existing tax problem, Victory Tax Lawyers are here to stand between you and the Internal Revenue and protect your interests. Schedule your free consultation, and let’s begin your case.

FAQ

Here are answers to some of the most commonly asked questions on the taxation of employee benefits.

Should You Pay Taxes on Benefits Yourself?

While many employers report taxable benefits directly on your W-2, it’s your responsibility to ensure everything is correct, as your employer would not bear penalties that arise as a result of mistakes or omissions. So, keep detailed records of your benefits and review year-end statements carefully. If you’re not sure of something, speak with a tax professional so you don’t complicate things and get into trouble.

What Are Fringe Benefits?

A taxable fringe benefit is any extra compensation an employer provides in addition to an employee’s regular wages or salary. It’s basically a perk or benefit given for performing work. Examples include things like a company car, health insurance, gym memberships, or tuition assistance. They are generally considered taxable income unless otherwise exempted.

What are De Minimis Fringe Benefits

De minimis benefits are benefits provided to employees that have very little or no value or are provided seldomly, and hence, accounting for them is seen as unreasonable and administratively impracticable. Frequency and value are two key metrics considered when determining whether a benefit is de minimis.