One thing is assured when the Internal Revenue Service (IRS) begins taking steps to collect a tax debt: the taxpayer in question has the full right to push back. It is for this reason that the Collection Appeal Program (CAP) exists. The program gives taxpayers the liberty to file Form 9423 and challenge IRS collection actions like liens, levies, property seizures, or rejected installment agreement requests.

How and when to use the Form 9423 collection appeal request is a matter of timing and purpose. You file it to stop or address specific IRS collection actions before they happen or escalate. Filing this form at the right time and according to the form instructions will automatically put a temporary pause on enforcement and give you a chance to negotiate a better resolution.

At Victory Tax Lawyers, we go beyond guiding taxpayers through the process of filing IRS Form 9423. Our experienced tax attorneys can serve as your representative before the IRS during the appeal process, so you do not have to handle it by yourself. Schedule a free consultation now and let’s discuss how we can help you take care of the entire appeal process.

In this guide, we’ll explain what Form 9423 is, how the Collection Appeals Program works, and when it’s worth filing. You’ll also learn how to complete the form, where to send it, and how not to blow your chances of having a successful appeal.

What Is the IRS Collection Appeals Program?

The IRS Collection Appeals Program (CAP) is a fast-track process set in place by the Internal Revenue Service to give taxpayers full liberty to challenge certain collection actions without having to go through a formal court hearing. While this program was designed to help resolve disputes when the Internal Revenue Service comes knocking for collection, it does not give you appeal rights towards the tax you owe.

CAP is a more streamlined alternative when compared to the lengthier Collection Due Process (CDP) hearing. CDP cases can take months or even years and often require more formal procedures before a resolution occurs. However, the Collection Appeals Program is well-known for its speed. This speed alone can make a major difference in a case where you are facing time-sensitive collection threats like wage garnishment or seizure of assets.

It’s also important you know that once a CAP appeal decision is made, it’s final. This implies that neither you, the taxpayer, nor the revenue officer can request another administrative appeal on the same issue. Every involved party is bound by the decision, regardless of whether one party disagrees with the outcome.

What Is a Collection Appeal Request (Form 9423)?

IRS Form 9423, otherwise known as the Collection Appeal Request, is the official document used to appeal an IRS collection action before or shortly after it is issued. For most taxpayers, this is their chance to pause the IRS collection process and make their case, especially if they are in:

- Disagreement with an IRS tax levy or federal tax lien

- Disagreement with a terminated, modified, or rejected installment agreement

- Disagreement with Threats on asset seizure or sale

The purpose of Form 9423 is to protect your rights as a taxpayer. It gives you the opportunity to formally inform the IRS that you disagree with the collection process and request a review by a collection manager. The process can stop enforcement actions from continuing or at least buy you more time to propose a more reasonable solution.

When Should You File a Collection Appeal Request?

You should file a Collection Appeal Request (Form 9423) when you disagree with how the IRS handles a collection action and want to stop it from going further. Filing the form is appropriate in the following situations:

- Before a levy is enforced: Should there be a case where the IRS sends you a notice of proposed levy on your wages, bank account, or any other related property, you can decide to file Form 9423 to try to stop the enforcement of the levy if you believe the action is premature or unjustified.

- After a Notice of Federal Tax Lien is filed or proposed to be filed: Whenever the IRS files a tax lien against any property, it affects the taxpayer’s credit and alerts creditors that the IRS has a legal claim to the assets. If you find yourself in a similar case, you can file an appeal using IRS Form 9423 to dispute the lien or how it was handled.

- When an installment agreement is modified, terminated, or rejected: If you’ve applied for a payment plan like a direct debit installment agreement and the IRS rejects, modifies, or terminates it, filing the appeal form is a good way to push back and request a reconsideration.

- After the IRS seizes property: If your property has already been seized by the IRS, the collection appeal request form offers you the opportunity to explain why the seizure was not proper.

If your appeal is due to disagreement with a lien, levy or seizure, you must first contact the collection manager or IRS revenue office that issued the notice to resolve the issue. In case you do not resolve the issue with the collection officer, you can file Form 9423. The collection officer should be informed two business days after the conference that you intend to submit the form.

However, if your disagreement is due to a modified, rejected or terminated installment agreement, proceed with the Form 9423 filing and send it the the revenue officer that issued the notice within 30 days of receiving the notice.

In a case where you miss the time window, the IRS will move on with the enforcement, and your right to CAP appeal may be lost entirely. So, take note of the deadline and act promptly. However, if you’re unclear about the timing and whether this is the best option for you, consult a tax professional.

Where Should I Send Form 9423?

You should send your completed Form 9423 directly to the IRS employee, IRS revenue officer, or office that initiated or plans to initiate the collection action you’re appealing for. This means that you don’t just send it to a general IRS processing center you know of. Instead, it must be submitted to the exact appeals office or contact that is listed on the collection notice you received from the agency.

The IRS also generally requires that Form 9423 be submitted either by fax or mail. However, double-checking the most recent IRS notice you received is of utmost importance. The notice should indicate the correct mailing address or fax number. So, stick to the instructions and methods stated there.

If the notice doesn’t clearly indicate the destination of the form, call the IRS with the number provided on the notice or visit the IRS website to make a proper inquiry. Try your best never to guess or send the form to a generic IRS address or the IRS Independent Office of Appeals, because there are high chances that it will cause delays or your appeal may be entirely overlooked. You must also send the form using a trackable method like certified mail or include a fax confirmation page as proof that you submitted it on time.

Additionally, when dealing with IRS collection actions, documentation and diligence go a long way in increasing your chances of getting an approval. Before submitting the appeal request, keep a copy of the form and include all supporting documents, such as a Power of Attorney (Form 2848). This way, you can have a good backup and evidence just in case your appeal gets delayed, lost, or questioned by the agency in the next tax period.

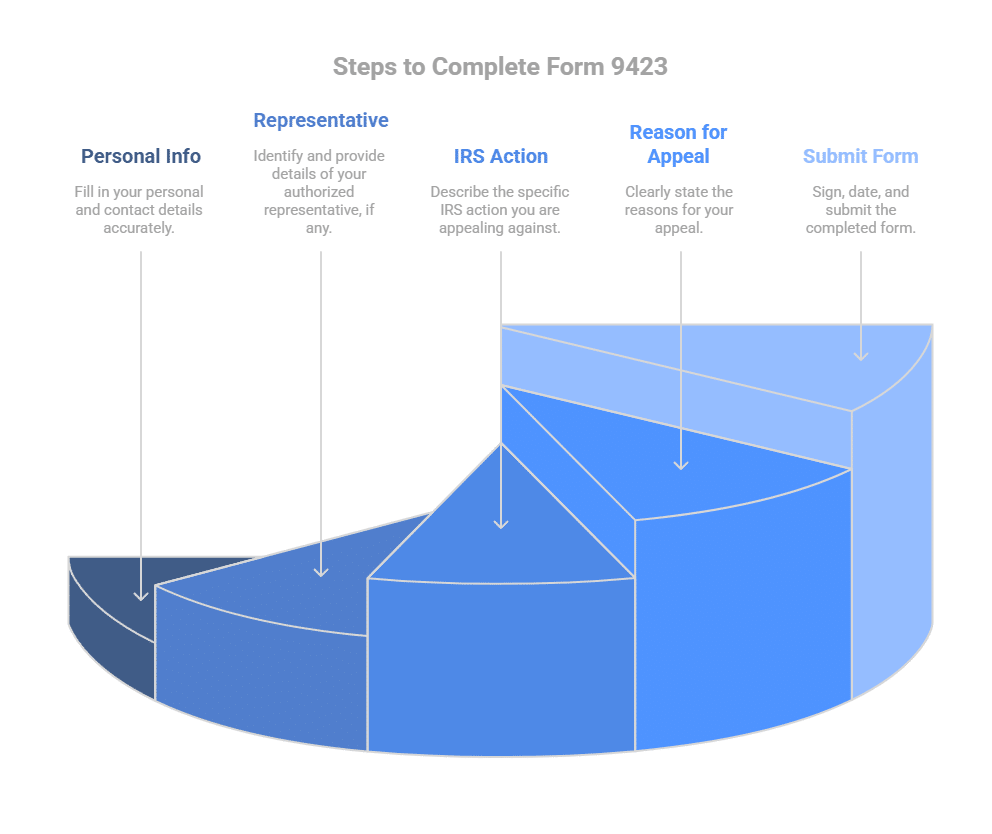

How to Complete Form 9423

Filing out Form 9423 is a straightforward process. Each section requires accuracy and thorough clarity, as whatever information you submit can influence how your appeal is handled. Your responses should be honest, transparent, and supported with relevant documentation. To get started with the form completion, make sure to follow these steps:

Enter Your Personal and Contact Information

The first section of the Form 9423 you’ll have to fill out has to do with your details. This is where you must include your full legal name, Social Security Number (SSN), or, if you’re appealing as a business, your Employer Identification Number (EIN). Make sure that every piece of the information you provide is the same as what’s on file with the IRS.

Once you’ve provided your basic personal information, proceed to fill in your full mailing address, including your city, state and ZIP code. Double-check your entries before you move further, as this is the exact address where the IRS will send important follow-up notices or their final decision.

Additionally, you’ll be asked to provide a daytime phone number. This isn’t just for formalities. The IRS collection office might need to contact you for clarification or to schedule an appeals conference, so fill in a number where you’ll be reached easily during business hours.

Identify Your Authorized Representative (If Applicable)

Some taxpayers prefer to have a tax professional speak on their behalf during the appeal process, and this is generally accepted by the IRS. It could be an enrolled agent, Certified Public Accountant (CPA), or tax attorney who has experience in dealing directly with the IRS. If you choose to be represented, list your representative’s full name, contact number and mailing address in the required section.

In addition, the IRS requires that you attach a signed Form 2848, a Power of Attorney and Declaration of Representative form. This gives your representative the full legal authority to speak for you and access information concerning your tax account. If the IRS already has a valid Form 2848 on file, skip the process. However, in case you’ve already filed the form for another matter and you’re not sure whether it applies here, it’s best to include it again to prevent any delay.

Also, keep in mind that you can skip this section entirely if you’re managing the appeal yourself. However, if the details of your case are complicated or you’ve already had prior difficulty in getting the IRS to understand your situation, reach out to a tax attorney to make the communication process smoother and more effective.

Describe the IRS Action You Are Appealing

Section 14 in IRS Form 9423 is considered the heart of your appeal. Here, you’ll clearly describe the specific IRS collection action you are challenging. It could be a proposed or already levied property tax on your wages or bank account, a filing of a tax lien, seizure of your property, or a rejected installment agreement.

Though this may be a one-page form with limited space for description, provide further detail on a separate sheet and attach it to the form. Be as precise as possible when communicating. Also, when describing the action, reference any IRS notice or letter numbers that are tied to the action. This will help the IRS locate your case faster and make sure your appeal is directed towards the correct action.

State the Reason for Your Appeal

Once you’ve described the collection action, section 15 is where you explain why you disagree with the IRS action. Your explanation should be clear, grounded in facts, and supported by the necessary documentation, such as:

- Proof of prior payments or an installment agreement

- Documentation showing financial hardship (e.g., income statements, expense breakdowns)

- Evidence that the IRS’s action was based on incorrect or outdated information

- A history of past compliance

When stating your reason, also keep your tone professional and respectful, and avoid emotional appeals. The IRS is focused on facts, not feelings. If your case involves a complex issue, a tax professional can help you phrase this section properly and add the necessary supporting references.

Sign, Date, and Submit Form 9423

You or your representative must sign and date the IRS Form 9423 before it is considered valid for submission. An unsigned form can delay your appeal or cause instant rejection of your request.

After the form is signed and dated appropriately, send it to the IRS employee or office that issued the notice or took the collection action. As stated earlier, the form should be submitted by fax or mail, depending on the instructions in your IRS letter. You should keep a copy of the signed form and any attachments or supporting documents for your records.

What Happens After You Submit Form 9423?

You have about three business days from when you had a conference with an IRS revenue officer or collection manager who issued the notice to submit Form 9423. The IRS will temporarily put a stop to the collection action after you submit Form 9423 once you stick to the required timeframe. If not, the temporary stop may be reversed.

The IRS form will be forwarded to a collection manager who was not previously involved in your case to ensure there’s an impartial appeals review. The collection manager will look over your request, review supporting documentation, and determine whether the collection action should proceed as planned.

In many cases, the collection manager may schedule a phone or in-person conference where you or your representative can explain your case further. The conference isn’t always required. However, when you’re invited, utilize the opportunity to clarify your position, explain any misunderstandings, and present additional evidence if needed.

What Happens if Your Collection Appeal Is Approved

The IRS may stop, modify, or reverse the collection action if your appeal is approved. This implies that they could either release a levy, halt the filing of a lien, or reinstate a rejected proposed installment agreement, depending on your appeal request.

You’ll also receive written confirmation of the decision and any new applicable terms or conditions. Be sure to comply with these terms, as failure to do so could make the IRS restart the collection process.

What Happens if Your Collection Appeal Is Denied

If the IRS appeal is denied, you will no longer be eligible to submit another Collection Appeals Program (CAP) request for the same issue. Decisions from the CAP are binding and final within the IRS system. However, this doesn’t mean you’re left without options.

You may still be able to file a request through the Collection Due Process (CDP) program if the 30-day time window from when the collection notice was issued has not yet closed. Alternatively, you could also contact the Taxpayer Advocate Service for additional support, especially if you believe your rights were violated or are experiencing financial hardship.

Collection Appeals Program vs. Collection Due Process Hearing

There are two major ways to appeal IRS collection actions: the Collection Appeals Program (CAP) and the Collection Due Process (CDP). Both avenues are designed to protect taxpayer rights in collection actions, but they have slightly different purposes.

A core difference is what each process allows you to challenge. CAP is strictly concerned with collection actions such as liens, levies, seizures, or the rejection of installment agreements. On the other hand, not only can you appeal collection actions with a CDP hearing, you can also challenge penalties, interest, and even the underlying tax liability itself.

You can qualify for a Collection Appeals Program (CAP) when the IRS either:

- Files or proposes to file a tax lien

- Issues a levy notice

- Seizes or intends to seize property

- Rejects, modifies, or terminates your installment agreement

For Collection Due Process (CDP), you qualify for a hearing when the IRS must have sent you:

You have just 30 days from the date of these notices to request a CDP hearing using Form 12153. Miss that deadline and automatically lose the right to a full hearing.

Pros and Cons of CAP and CDP

An important advantage of the Collection Appeals Program (CAP) is speed. You can resolve issues within a few days and stop IRS action. The process is also formal, so you may not have to attend a hearing. However, it also has its limitations. As stated earlier, CAP does not allow you to dispute the tax amount you owe. You can only file IRS Form 9423 to dispute a tax collection action. Also, once the IRS concludes CAP, you can not request further appeals within the agency.

When it comes to a Collection Due Process Hearing, you have full liberty to challenge both the collection action and the tax amount you owe. Plus, you maintain the right to escalate the issue to a tax court if you’re still unsatisfied and can request tax relief alternatives like an Offer in Compromise or penalty abatement. The disadvantage is that the speed of resolution is slower and may take several months. It also involves more paperwork and a formal process.

How Do You Write a Powerful Appeal Letter?

A powerful IRS appeal letter must communicate the intent clearly, include supporting documentation, and focus on resolving the issue. Aim to help the IRS understand your position quickly and make a fair decision.

Be Clear About What You’re Appealing

Begin your letter by clearly describing the IRS action you disagree with. Be sure to emphasize details such as the notice number, tax year involved, and the date you received the notice.

Explain Your Reasons in Detail

When explaining why you disagree with the action, stick to the facts. If you experienced financial hardship, provide dates, job loss or illness details, and any relevant changes in income or expenses. Also, avoid the use of emotional language. Your explanation should be professional, respectful, and direct.

Include Supporting Documentation

Don’t expect the IRS to just take your word; they need evidence. Make sure to include copies of pay stubs, bank statements, medical bills, or any other documents that support your case. Proper documentation gives your appeal credibility.

Stay Respectful and Focused

Avoid letting frustration leak into your tone. Even if you feel the IRS was unfair or slow to respond, a respectful and solution-focused tone goes much further than blaming or emotional appeals.

Consider Working With a Tax Professional

If your case is complex or you’re unsure how to explain your position effectively, a tax professional can help draft a compelling and accurate appeal letter. They understand how the IRS evaluates cases and what documentation will give you a better chance. Hiring an expert in the field can also help you avoid delays or rejections due to missing or unclear information.

Need a Tax Attorney for the Collection Appeals Process?

The Collection Appeals Program gives you an avenue to stop or prevent collection actions from taking place. To increase your chances of getting approved, you must move quickly and follow the process properly.

Timing is very important, and so is accuracy. The IRS also expects your filed Form 9423 to be clear, specific, and depict professionalism. There’s no room for guesswork or half-filled forms. So, to avoid any form of mistake, as one missed step can cost you denial, secure the help of a tax professional.

At Victory Tax Lawyers, we’ve helped different taxpayers challenge the IRS with clarity, precision, and legal strength. So, if you are dealing with a sudden levy or a terminated existing installment agreement, we have the best tax lawyers who can represent you and help you take swift and informed action. Schedule a free consultation or visit us in person at our Los Angeles office.

FAQs

Can I Appeal an IRS Garnishment?

Yes, you can. If the IRS plans to garnish your wages and you disagree, you can file IRS Form 9423 before the garnishment starts. In a case where you want to stop wage garnishment that is already in motion, an appeal can still help. However, you must file quickly and must include strong documentation to support your case.

Who Can File Form 9423?

Any taxpayer or business facing an IRS collection action can file Form 9423. This includes individuals or corporations that have been hit with a lien, levy, property seizure, or rejected installment agreement.

How Long Do I Have to File a Collection Appeal Request?

The amount of time you have depends on the type of action. For rejected installment agreements, you usually have 30 days. For levies or seizures, the deadline may be even tighter. Check the IRS notice you received, as it will indicate your appeal window.